Tech firms profit from soaring demand for the computing power essential for artificial intelligence operations.

With the global recognition of generative AI in 2023, an unparalleled need for computing power has arisen, paralleling the surge in demand for applications harnessing this technology.

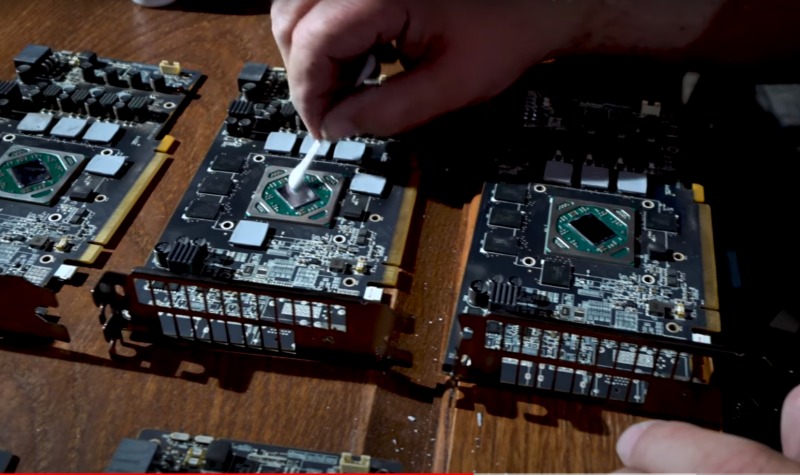

Tools like OpenAI’s ChatGPT necessitate the deployment of thousands of Nvidia GPUs (graphics processing units) to effectively handle the influx of input and produce output seamlessly. Nvidia recently likened GPUs to rare earth metals for AI, emphasizing their fundamental role in the current operation of generative AI.

Powering all this hardware demands energy equivalent to that of a small country, as revealed in a report by French energy company Schneider Electric last year. During a Davos audience address on Wednesday, OpenAI’s CEO, Sam Altman, emphasized the necessity for an energy breakthrough to drive AI advancements, expressing the need for increased investment in nuclear fusion.

Earlier this year, Fortune Business Insights estimated the global GPU market size at US$2.39bn in 2022, projecting growth from US$3.16bn in 2023 to US$25.53bn by 2030. Nvidia asserts that over 40,000 companies utilize Nvidia GPUs for AI and accelerated computing.

In response to the surge in demand, Nvidia revealed plans in August to triple its GPU production. Following suit, Microsoft entered a multi-year agreement with Oracle in November to provide computing power for its Bing Chat AI feature.

Currently, companies previously catering to the cryptocurrency mining boom are strategically shifting their focus to capitalize on the ongoing data gold rush.

In July, the Canadian firm Hive Blockchain underwent a name change to Hive Digital Technologies and revealed its shift towards AI.

Hive has been a trailblazer in the cryptocurrency mining sector since 2017. The adoption of a new name indicates a substantial strategic transition to leverage the capabilities of GPU Cloud compute technology, a crucial tool in the realms of AI, machine learning, and advanced data analysis. This enables us to broaden our revenue streams through our Nvidia GPU fleet,” stated the company in its announcement at that time.

Frank Holmes, the company’s executive chairman, shared with Guardian Australia that the transition demanded considerable effort.

Transitioning from Ethereum mining to hosting GPU cloud services involves acquiring potent new servers for GPUs, upgrading networking equipment, and relocating to advanced-tier data centers,” he explained.

“The only common factor is that GPUs serve as the workhorses in both scenarios. GPU cloud necessitates higher-end supporting hardware and a more secure, faster data center environment. The GPU cloud business presents a steep learning curve, but our team is adapting adeptly and learning swiftly.”

For some, like Iris Energy, a data center company operating in Canada and Texas and co-founded by Australian Daniel Roberts, this has been the plan from the outset. When the AI boom emerged, Iris did not need to alter its operations, Roberts told Guardian Australia.

“Our strategy has really been about bootstrapping the data center platform with bitcoin mining and then preserving optionality on the entire digital world. The distinction with us and crypto-miners is that we’re not primarily miners; we’re data center people.”

While the company still emphasizes its bitcoin mining capability, the latest results highlight Iris’s positioning for “power-dense computing” with 100% renewable energy. Roberts stressed that it’s not an either-or situation between bitcoin mining and AI.

I believe that when you compare bitcoin to AI, the market will naturally find equilibrium depending on the demand for each product in the market,” he stated.

“Bitcoin is in demand as a store of value, often referred to as gold 2.0… its value will rise, driven by economic incentives to secure it.

“On the other hand, as adoption of AI expands, people will be willing to pay for that. And for us, we have the flexibility to shift between the two and optimize our strategy based on the prevailing circumstances.”

Holmes mentioned that Hive perceives both industries as operating concurrently.

“We have a strong affinity for the bitcoin mining business, but its revenue tends to be somewhat unpredictable. GPU cloud services should complement it effectively,” he expressed.

“The revenue is expected to be more consistent, while still offering appealing margins and the potential for rapid expansion.”

Despite the declaration of a “crypto winter” in 2023, the value of bitcoin surged to a two-year high of US$49,061 on January 11, following the approval of the first US-listed exchange-traded funds (ETF) to track bitcoin by the US securities regulator. However, it subsequently dipped back below US$40,000 this week.

Similar to cryptocurrency mining, the substantial computing power demanded by AI systems results in extensive energy consumption and carbon emissions at some centers.

AI companies like OpenAI do not disclose their carbon emission figures, but estimates suggest that the training of the previous iteration of GPT, GPT-3, consumed 1,287 megawatt-hours of electricity and produced 552 tonnes of CO2 – equivalent to the emissions from 123 fossil-fuel-powered cars driven for one year.

Iris Energy regards its use of renewables not only as environmentally friendly but also as a cost-effective measure.

“We have ventured to locations with abundant low-cost excess renewables, where we have access to ample land and power,” Roberts explained. “[At our] Texas site, we have a 600-megawatt grid connection in an area boasting 32 gigawatts of wind and solar. The transmission line is 12 gigawatts to export that energy down to Dallas and Houston.

While there is significant enthusiasm, some observers are approaching the market shift with skepticism, suggesting that some entities might be swiftly transitioning from one trend to another.

In August, Institutional Investor reported that a company labeled a “penny stock,” Applied Sciences, had transformed itself into a bitcoin miner hosting firm in April 2022 under the name Applied Bitcoin. However, sensing the evolving investment landscape, by November 2022, it rebranded as Applied Digital, with a newfound focus on AI.